“Number 8 may shock you!”

The COVID-19 outbreak and Russia’s invasion of Ukraine had a negative economic impact, making it harder for many African countries to pay down their national debt.

According to the United Kingdom’s Chatham House, more than 20 low-income African nations were at a high risk of defaulting.

Bloomberg revealed that China accounts for 12% of Africa’s $696 billion (KSh 94 trillion) external debt.

Due to the extent of Chinese lending, the World Bank noted that seven African nations were either in debt distress or at risk of debt distress.

These countries include Kenya, Angola, Djibouti, and Zambia.

Why are African countries at risk of defaulting?

FX Pesa lead market analyst Rufas Kamau noted that most African countries, including Kenya, had United States (US) dollar-denominated loans.

He explained that obligations grow when the US Federal Reserve raises interest rates because the countries use their weak local currencies to acquire a strong dollar.

“Kenya, like many other economies in the global south, has debts in US dollars. When the Federal Reserve raises interest rates, Kenya’s obligations grow larger because it must spend more shillings to acquire an appreciating dollar and then use it to repay loans. The risk of these countries defaulting on their bonds is thus elevated, resulting in a flow of cash away from the frontier and emerging economies and toward developed ones,” Kamau told TUKO.co.ke.

He explained that the Kenyan government pursues bilateral agreements with its key trading partners to relieve strain on foreign currency reserves.

“It’s in the interest of the Kenyan government to enter bilateral deals with top trade partners to ease the pressure on foreign currency reserves,” Kamau told TUKO.co.ke.

African countries with the highest Chinese debt

1. Angola

Over the past 20 years, China’s debt exposure to Angola increased significantly.

The Angolan government prioritised reconstruction after the civil war concluded in 2002.

China made a major contribution by initiating over 100 projects, most of which were funded by oil loans in energy, water, health, education, telecommunications, fisheries, and public works.

According to Business Insider, Angola’s debt to China stood at $42,619 million (KSh 5.7 trillion) as of 2023.

2. Ethiopia

As of the end of March 2023, Ethiopia owed $28.2 billion (KSh 3.8 trillion) in foreign debt.

Nearly half of the country’s total debt, $13.7 billion (KSh 1.84 trillion), is owed to China.

3. Zambia

Approximately one-third of the Zambian government’s external debt is owed to China, the country’s largest creditor.

Zambia owes China an estimated KSh 1.33 trillion.

4. Kenya

Kenyans continue to feel the pinch in the repayment of the Chinese loans that funded major infrastructural projects, including the Standard Gauge Railway (SGR).

Data from the National Treasury indicated that the debt repayment increased by about half to KSh 107.42 billion in the financial year 2022/23.

Kenya’s debt to China stands at over KSh 1.2 trillion.

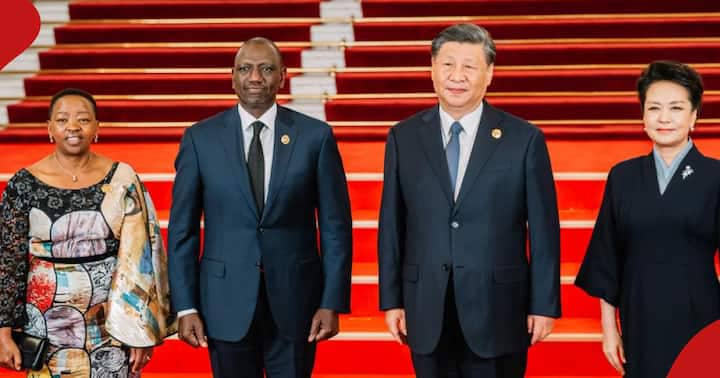

President William Ruto’s administration plans to introduce a $500 million (KSh 67.5 billion) Panda Bond from the Asian nation to cover the 2024/2025 budget deficit.

6. Cameroon

Cameroon is another African country borrowing funds from China to fund its budget.

The West African nation’s debt to China is KSh 837 billion.

6. Sudan

Throughout the 2000s, China provided Sudan with billions of loans and investments to support oil production and economic growth.

7. The Democratic Republic of Congo (DRC)

Between 2000 and 2018, the South China Morning Post reported the DRC borrowed $2.4 billion in 53 loans from China for mining, transportation and electricity projects.

The total loan owed to China currently stands at over KSh 727.7 billion.

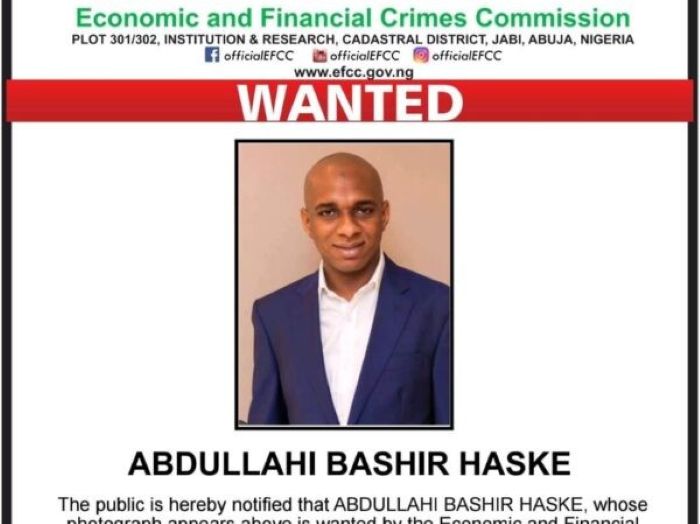

8. Nigeria

Legit News reported that the Nigerian Debt Management Office (DMO) revealed that during the second half of 2023, the country’s debt commitments to China rose by nearly $500 million to $5.16 billion (KSh 696.6 billion).

China is Nigeria’s largest bilateral creditor by a wide margin, although its percentage of the nation’s $68 billion total public debt is still quite low, just under 7%.

TUKO.co.ke